As regular readers know I am passionate about anything related to Bitcoin, especially applications that use the blockchain for more than just monetary transactions. One company that I have been following since their launch in January is Ethereum, a platform and programming language for applications built on top of a new distributed ledger (blockchain). Business Insider named them the most hyped digital currency since Bitcoin, and I think that is a correct title.

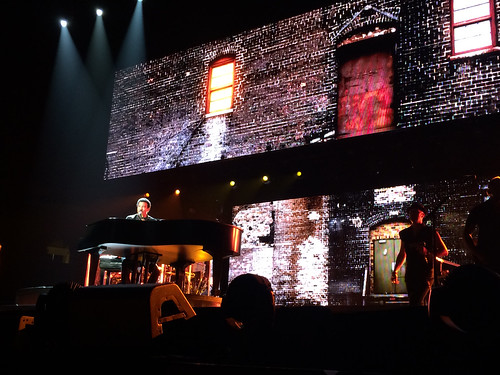

Vitalik Buterin introducing Ethereum at the Miami conference

After Ethereum was introduced to the world in January at the Miami Bitcoin Conference, its 21-year old genius founder Vitalik Buterin became an instant rock star in the Bitcoin world. People even started comparing him to Bitcoin inventor Satoshi Nakamoto. Vitalik announced at that time that Ethereum would launch its crowdsale IPO on February 1, and I had planned to buy some Ether during that time.

However, right before the IPO should take place the sale was cancelled and since then there have not been a lot of official announcements. Because of how they handled their potential investors I decided not to put any money into Ethereum if they would try to do their IPO again. When you can’t even handle a simple crowdsale well, I wonder if you are mature enough to run an altcoin platform that should change the way we do business.

People all wanted to talk to Vitalik after his talk in Miami

Well, this week Ethereum finally launched its funding, this time without any advance notice. At least, I did not get the message and I also don’t think Vitalik mentioned it at the Chicago conference last weekend. But that did not matter, because the IPO was a HUGE success: after 2 days they already raised almost 7000 bitcoins, which is about US$ 4.8 million at current prices.

To me that was a surprise, I knew the company was hyped but I had not expected such a major hype. Why? Simply because the company is still purely a powerpoint and a couple of geeks talking at conferences about their ideas. Very good ideas I have to say, but there is no product yet and there won’t be a product until at least 6 months later. But that’s not all, because they are selling Ether (their currency) without announcing how many Ether they will selling in total (it’s an open-ended crowdsale). That means you have no clue what percentage of the company you will buy or, in venture capital language, you invest without knowing the valuation of the company.

And what do you get for that? Moe Levin put it well in a podcast interview today in which he called Ether “Casino chips that can only be used in one casino”. It may be a huge casino eventually, or maybe there will never be a casino. Or they will just keep printing new chips for new users, diluting the value of the current chips.

To make matters worse, anybody can copy Ethereum’s source code (it’s open source, so anybody can see it) and start a copy of Ethereum that works exactly the same. And that’s already being done, last night Aethereum (Yes, just one letter difference) was announced and this platform will give its coins away for free based on how many Bitcoins you own.

USD 4.8 million is a lot of money, a lot more money than the company needs to build its product. They are a low cost operation, basically just a bunch of young but very smart developers, who all get Ether as well for their efforts (if I remember correctly 9.9% of all Ether is set aside for the founders).

As a rational investor I would never put money into such a venture, but it seems most Ethereum investors are not rational. Ethereum uses an interesting incentive to get people to buy quickly, because after 14 days the price of Ether will go up. That means you’ll have a limited time to buy at the current price. This may be part of the reason why people want to put money in as soon as possible. On social media people are arguing that they just invest to help the team, and that may be true. However, I believe 4.8 million is a lot of money to give away to help a young team to build a good product, even in the Bitcoin world.

To be fair, the Ethereum team did nothing wrong (well, they botched their first IPO and are terrible at investor communications) and they are very clear about the fact what they offer. It’s not a pump and dump. They mention it’s not a regular investment, you just get coins that do not even exist yet. Maybe Ether will become very valuable or maybe it will never have any value, to me that’s gambling.

And that’s fine, but you won’t see me put any money into Ethereum until after they launch their coins and until they get some traction. The Bitcoin world changes so fast that by then another competitor may have emerged that is better or faster. Congrats to the team for raising so much money so easily, now the pressure is on them to deliver on the expectations they created.